Get This Report about Certified Public Accountant

Table of ContentsSome Of Tax PreparationThe Definitive Guide for Tax Attorney In FloridaHow 1099k Ebay can Save You Time, Stress, and Money.The Main Principles Of Florida Llc Tax The Ultimate Guide To Florida Llc TaxFinancial Planner - An Overview

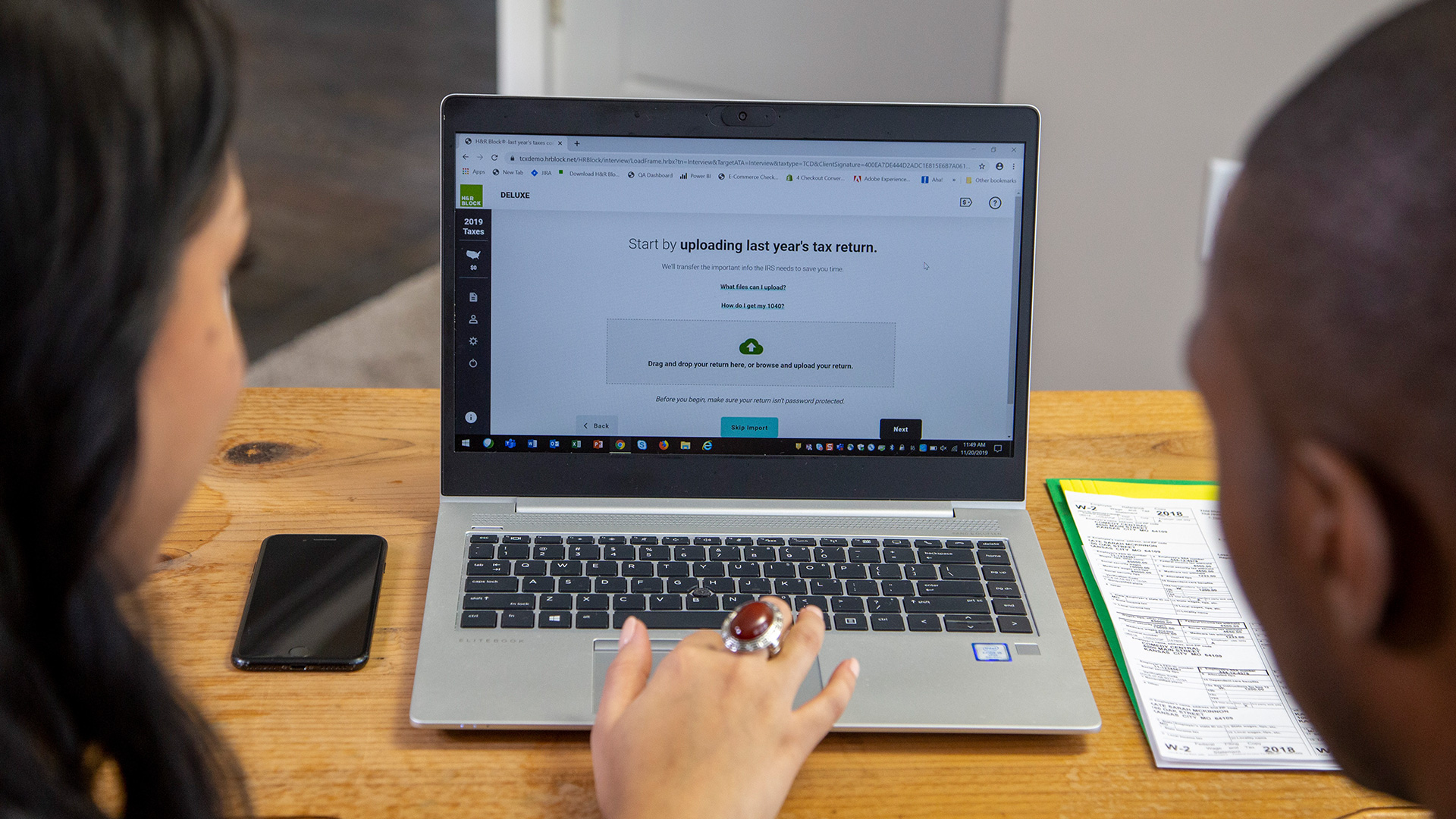

Likewise, the real declaring procedure can go much more swiftly if the solution you pick aids you consider your choices as well as allows you know if anything is missing out on. On the internet tax obligation prep work services generally stroll you via the entire process, asking questions to help you stay clear of errors. Some people like dealing with an additional human when experiencing a complicated procedure like a tax return.If you collaborate with the exact same tax obligation expert every year, that individual might be available throughout the year to give guidance based upon your certain circumstance. If you wind up getting audited, a tax obligation professional may be able to aid and potentially also moderate with the IRS on your behalf.

It's important to weigh the worth of expert tax obligation preparation versus the price. llc taxes in florida. You may not need to spend for income tax return prep work if you don't intend to, especially if your returns are rather simple. Free on-line tax obligation prep work software may have the ability to guide you detailed via the tax filing process to assist you prevent blunders and take full advantage of any kind of reimbursement

The Of Irs Withholding Calculator 2023

is elderly manager of tax obligation procedures for Credit scores Fate. She has greater than a lots years of experience in tax obligation, accountancy as well as service operations. Christina founded her own accountancy working as a consultant as well as handled it for more than 6 years. She co-developed an on-line do it yourself tax-preparation item, acting as primary operating officer for 7 years.

You can find her on Linked, In.

Tax obligation prep work appears like an easy task, but it calls for experience, experience, as well as the right devices. The very best tax obligation software for CPAs and audit firms helps in making this task simpler with automation as well as other powerful attributes. Utilizing this software application is very easy, but still, it additionally needs some skills to make the right use of these devices.

The 3-Minute Rule for Florida Llc Tax

This boosts revenue-generating possibilities for CPAs as well as tax obligation prep work company. As business increases, the stress of managing all tax obligation prep work work also increases. CPA tax preparation needs an extra precise technique to maintain clients happy. They need to make certain that they have the finest tax software for CPAs as well as accountancy firms to give satisfying service to their customers by completing perfect tax obligation returns.

This boosts revenue-generating possibilities for CPAs as well as tax obligation prep work company. As business increases, the stress of managing all tax obligation prep work work also increases. CPA tax preparation needs an extra precise technique to maintain clients happy. They need to make certain that they have the finest tax software for CPAs as well as accountancy firms to give satisfying service to their customers by completing perfect tax obligation returns.It is essential to recognize the ideal tool that has the ideal functions and also characteristics. If you are running a CPA firm that supplies the most effective-, after that your tax obligation preparation software must have the list below elements: CPA and also accounting companies manage massive data entry while doing tax prep work tasks.

of each customer as well as carrying out data access. This is a tiresome as well as error-prone task, which can be automated by the best tax obligation software program for CPAs and also audit firms. Automation of data entry not just guarantees that all access are accurate but additionally makes certain that no value gets lost out by chance.

8 Easy Facts About Certified Public Accountant Described

This further streamlines the task of data management because currently data can be instantly click for more stored in the tax obligation prep work software application. The job of a CPA company is not just preparing taxes as well as filling it, however they likewise need to see to it they adhere to legislation and produce simple to comprehend records.

This further streamlines the task of data management because currently data can be instantly click for more stored in the tax obligation prep work software application. The job of a CPA company is not just preparing taxes as well as filling it, however they likewise need to see to it they adhere to legislation and produce simple to comprehend records.The very best platform allows accounting professionals create different records to give the required info to clients. The finest tax software application for CPAs as well as accountancy companies also offers process automation and simplified partnership choices within the software application - irs withholding calculator 2023. This makes points simpler since reports and information can be traded in between a CPA company as well as client at their fingertips as well as none of them require to bother with taking care of several devices, one for interaction, one for information sharing, as well as one for cooperation

It supplies a remote accessibility center to use the system from anywhere, any time, which makes it perfect to supply outsourced tax obligation prep work solutions. It combines collaboration. It dramatically increases performance. To obtain a price for this best tax obligation software for CPAs as well as bookkeeping companies, you require to get in touch with its sales team.

How Llc Taxes In Florida can Save You Time, Stress, and Money.

4 various means to prepare tax Real-time reimbursement calculation Automated federal e-files Consolidated protection It is exceptionally easy to migrate from Turbo, Tax Obligation to H&R Block. It is budget friendly for any type of private and also service, that makes it perfect to supply outsourced tax preparation solutions. tax services. It is additionally offered totally free

Submit with a tax pro variation prices 85 USD + Extra state cost Monitoring of document Management of information storage space Administration of compliance Workflow monitoring Adaptability to arrangement several screens Automated tax obligation calculation Data import and also export Confirmation of information Digital trademark Reporting It is very easy to make use of. It is the due to the fact that it makes certain 100% precision It helps in producing quarterly as well as yearly strategies.

Tax obligation analysis Tax obligation planning Thousands of kinds to provide to various customers Missing out on customer here are the findings information device Test balance Paperless tax filing processes Automated tax computation Diagnosis of tax mistakes E-signature It saves time. It is the ideal tax obligation software program for CPAs and also accountancy companies for handling multiple customers.

Florida Llc Tax for Beginners

To get the price of this tax obligation preparation software program, you need to speak to the sales team. Tax coordinator E-signature Automated data circulation Back-up and also bring back Archiving of returns Tax estimator Scheduler Tax obligation Contrast As Well As more It is one of the ideal tax obligation software application for Certified public accountants as well as bookkeeping firms, which supplies outstanding safety.